Playing a vital role in helping companies realise their true potential, we uncover value by identifying and enhancing their performance by providing human capital and technology focus as core themes, amongst other important factors. Our approach helps our portfolio companies grow core businesses, launch new initiatives, make transformative acquisitions and upgrade technologies and systems to support their long-term strategy.

We provide more than just capital. We seek to make the companies we invest in stronger through a top-down strategy. We bring expertise of our Advisory Group to provide strategic guidance on a variety of operational improvements, including revenue growth, procurement, leadership development, lean process and technology, sustainability, human capital factors etc.

Creating Impact

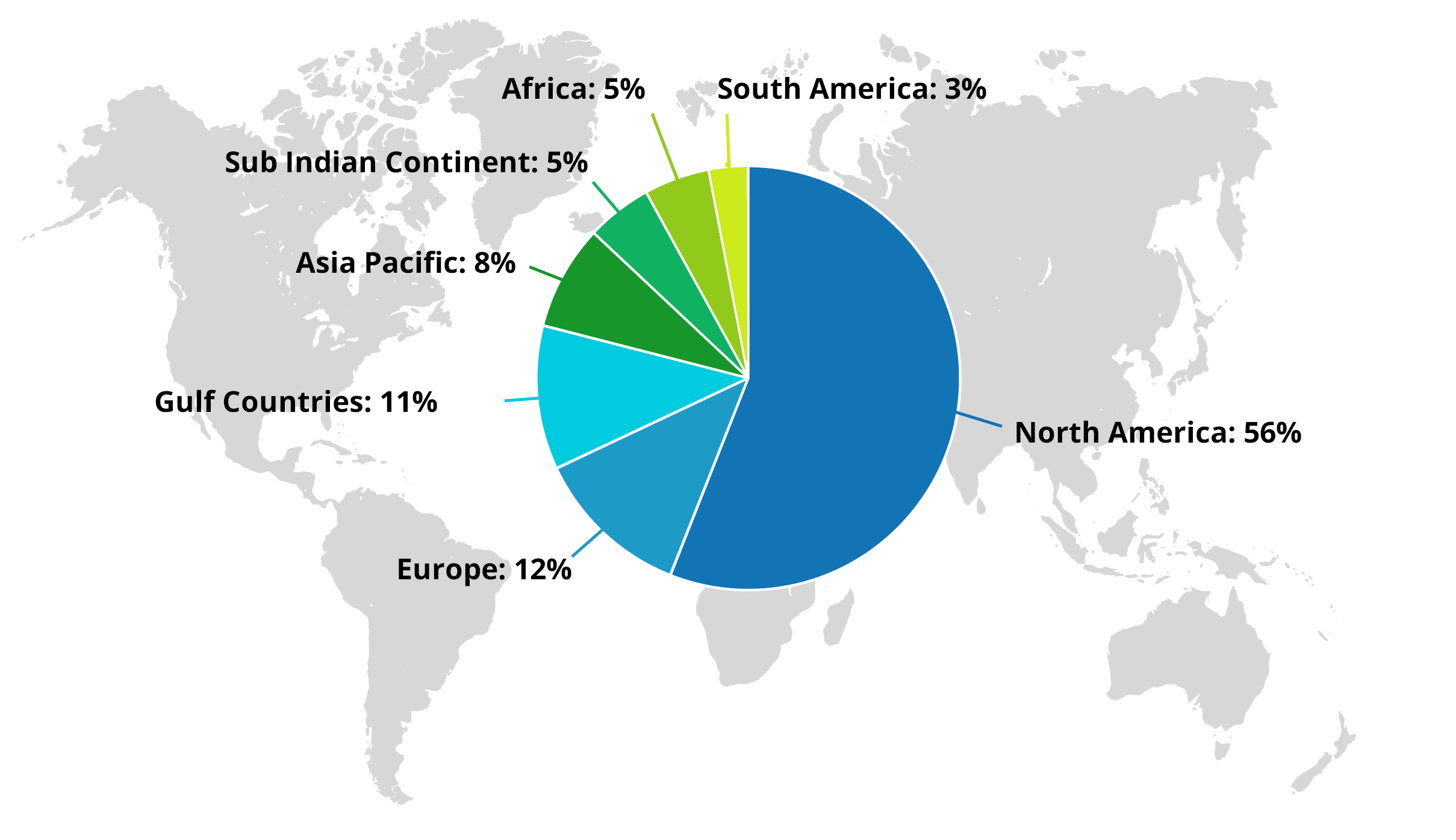

We strive to create value by investing in businesses where our capital, relationships, operational support and strategic insight can unlock a company’s potential. In addition to benefiting our investors, the improvements in growth and competitiveness benefit workers, communities and other stakeholders at large.

We are long-term investors who practice the art value creation and committed to achieving the best long-term outcomes for our businesses and our investors. It takes time to realise value creation from our principal core themes in human capital and/or technology, especially in the emerging markets.

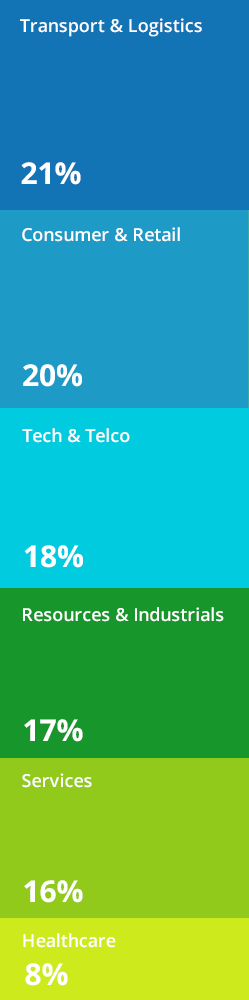

Our Portfolio

Our investment portfolio is distributed across different industry sectors. Half of our funds is pure play technology whilst the other half is towards human capital performance.